Tax Planning for the 2010

Zero % Capital Gain Rate Expiration

Capital Gain Tax Strategy

Analyzer Software

Since 2008, long-term capital gains have been taxed at either 0% or 15% depending on your ordinary income tax bracket. At the end of 2010, these low rates are set to expire, and will revert back to the old rates of 20%, or 10% (if you are only in the 15% ordinary income tax bracket.)

Essentially, your capital gain tax rate is set to increase by no less that 33.33% next year!

The expiration is a sunset provision, so Congress needs to do nothing. If Congress were to do something, rest assured the odds are the rates will go up even further.

I’ve been doing strategic tax planning with all my clients to take advantage of the zero tax bracket while we still have it. We brainstorm on timing of stock or real estate sales as well as other ways to generate capital gains such as related-party transactions (remember gains from related-party transactions have never been limited… only losses!)

As a simple example, I have a client who sold a publically traded stock in January for a capital gain of $75,000. His federal income tax bill is ZERO! If he had waited until next year, he would have paid more than $7,500.

Don’t have that kind of gain? Accelerating even a modest amount can yield savings. As an example, capital gain of only $3,000 would save approximately $450.

Planning is critical, and part of planning is first determining how much capital gain you can generate without paying income tax.

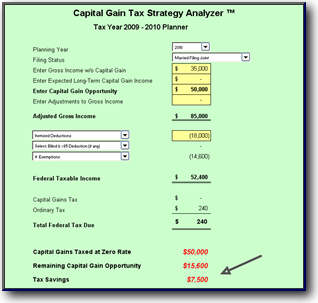

That’s where our 2009/2010 Capital Gain Tax Strategy Analyzer software can help you estimate how much of the “zero” tax bracket you have based on your personal tax situation. Simply enter your estimated income and deductions, and the software computes the capital gain “opportunity”.

|